How to Review Your Trades Weekly Like A Pro

TraderWaves Team • 20 May 2025 • 4 min read

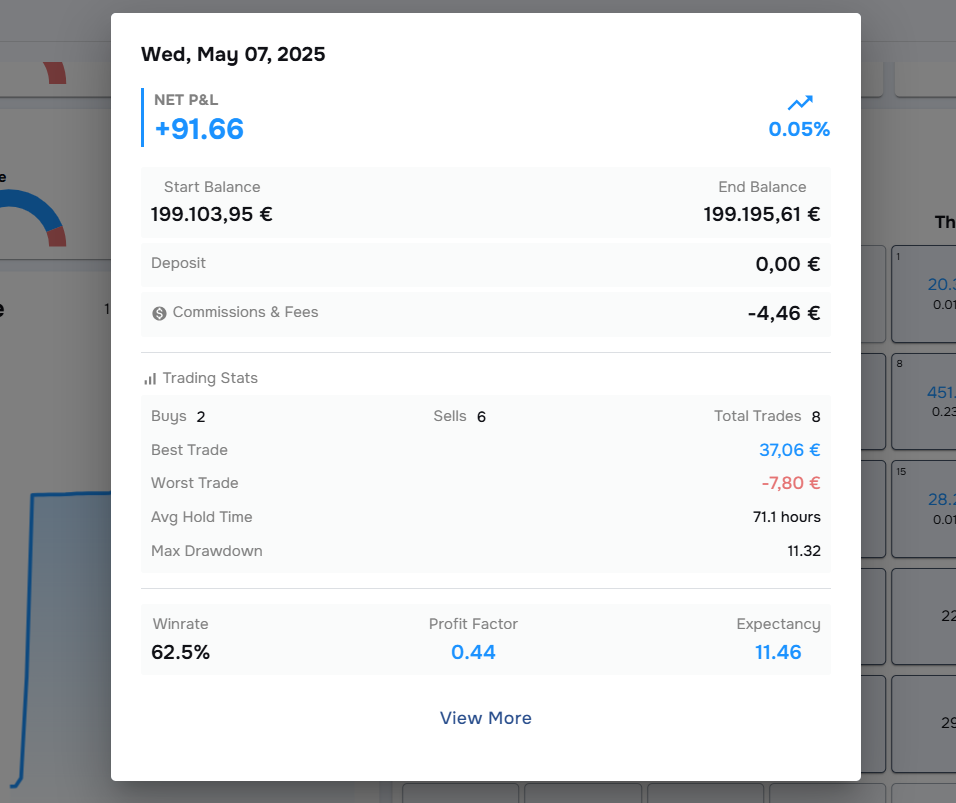

1. Performance overview: Trading dashboard

Knowing how to review trades can be a challenge for those just starting out. The first port of call for most traders when reviewing their week is the trading dashboard. Looking at your profit graph and balance chart and other trade performance metrics, gives you a high-level view of how the week went. It’s a great way to get a sense of your general consistency in one place. These charts and graphs are insightful but can be limiting if focused on in isolation.

For example, fixating on your win rate being low but you still have solid profits because your winners are larger. If you look instead at your performance as a whole, you can ask yourself: were you taking too many trades? And did only a few of them generate real profits? If you're following something like the 2% Rule, now’s a good time to check if you stayed within those limits or got overconfident during the week. The best way to analyse your stats is to not just look at one measure but at multiple. We recommend you set aside 5 minutes of in-depth analysis to focus purely on your overall performance that week.

Key takeaway: Your trading analytics dashboard is a great jumping off point to know how you are performing over the last week just be sure your analysis is well-rounded.

2. Weekly Overview: PnL Calendar patterns

The Profit and loss calendar is in a league of its own with the insights it provides. Most traders use it by quickly scanning the colour-coded days and moving on. The PnL calendar is much more powerful than that from monthly summaries to weekly totals and daily pattern recognition.

.

Daily PnL calendar view

Incorporating the P&L calendar into your weekly trade review reveals your consistency as well as allowing you to spot the patterns in your trades. Maybe you consistently perform better early in the week and hesitate closer to market closing. You might find your worst trades always happen after a losing day. The TraderWaves PnL calendar links to the daily journal you can select on a given day to investigate further and quickly add any notes, tags, or screenshots of your trades on the go.

In your weekly trade review:

– Start by checking your overall monthly performance for an overview of your trades

– Then dive deeper with the weekly view to begin pattern recognition

– Look for days that consistently underperform or outperform and visit the journal directly to make notes of your observations.

Key takeaway: Figuring out what works for you and how to avoid making costly mistakes is easier when you can spot the trends in your trades. This way you aren’t just reviewing what you achieved but how and when you’re achieving it.

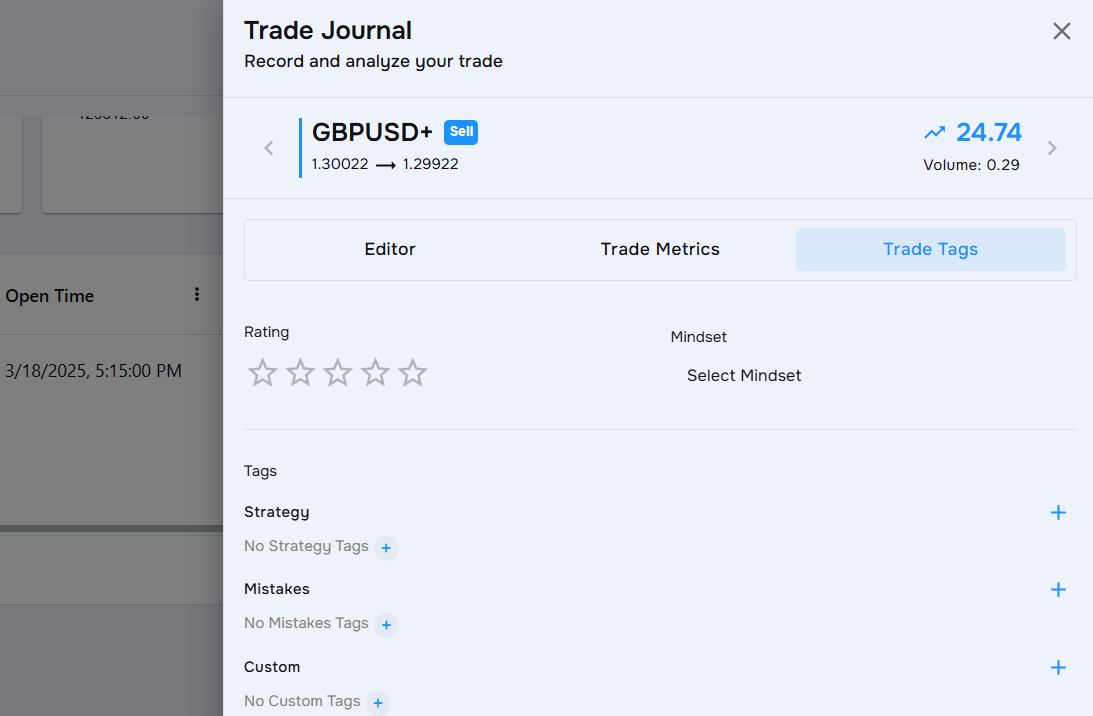

3. Daily Drill Down: Notes, Tags, and Trade Ratings

A trade journal is often a tool traders say they “don’t need”. That's because they view it as just some diary not as a powerful trading analytics tool that can help you maximise your profits!

If you're using multiple setups or strategies, your win rate won’t tell you which one is performing best. Your journal will. Tag each trade with the strategy or setup used, and then filter by those tags during your weekly review. This lets you quickly see which setups are resulting in wins and which ones you should cut loose. For beginners figuring out which strategy or setup works best, this is a game changer. You might even start to see the 80/20 pattern arise, where 20% of your trades are responsible for 80% of your profits. If you know which trades fall into that 20%, and why, that insight alone can reshape your trade plan.

The TraderWaves journal makes tagging your mindset and setups simple.

The journaling requires a bit of ‘homework’ in order to maximise its potential. However, the payoff is massive. You can customise the insights you want to gain. Reflecting on your past trades is key to understanding whether it’s your strategy or your trading psychology holding you back from profitability. Trading psychology is just a fancy term for your mindset when you take a trade which you can see the result of in revenge trades, exiting trades early, and FOMO trades. The trade journal tag system is the ideal way to log your mindset at the time to filter through to stop making the same trading mistakes.

Use the Trade journal in your weekly review to analyse:

– Which setups work best for you

– What time of day or week you perform best

– Which mindset patterns (e.g. FOMO, hesitation) are hurting your results

– When you deviate from your plan and (more importantly) find out why

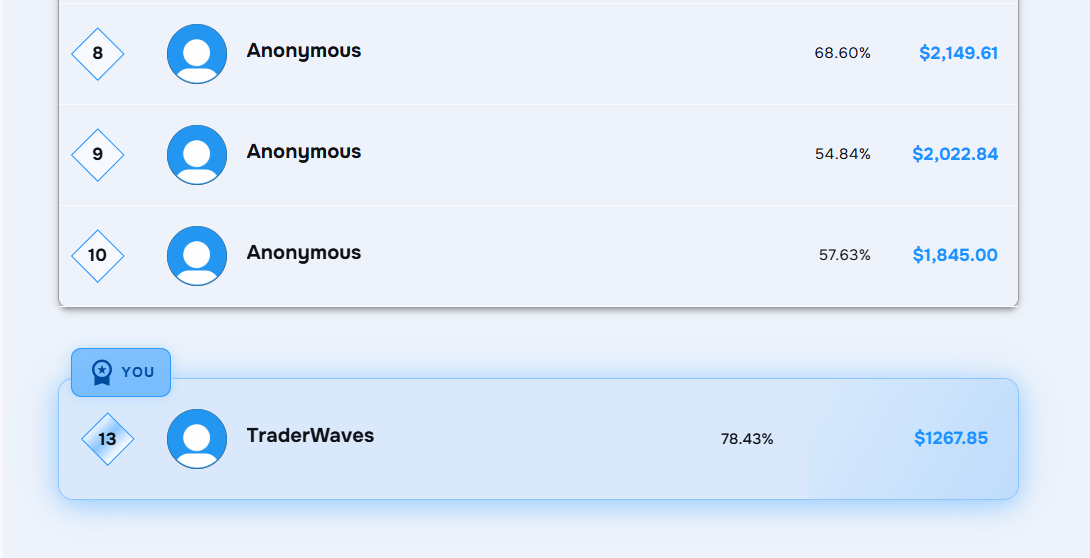

4. Reflect, Adjust, Optimise: Leaderboard position

Lastly, round out your review with the trading leaderboard. It allows you to see how you compare not necessarily against other people but also yourself. It is a great baseline to monitor how consistent your performance is. Are you on top one day and not ranking on others? If you’re ranking daily but not showing up weekly or monthly, it might suggest that you have some really strong days but you aren’t consistent in these wins.

Trader leaderboard view with user ranking

With the TraderWaves trading leaderboard you can compare directly your percentage gain and profit gains in your live and demo accounts. You can use it as a benchmark for your performance. The leaderboard is more than just a ranking it can inject a bit of fun into your routine. A healthy amount of competition, even with yourself, can be a strong motivator. If you are having a strong day, week, or month why not showcase your wins to other traders by setting your account to public. However, you don’t need to share your results with others but you could share them with a mentor if you wanted more feedback.

Why add the leaderboard as part of your weekly trade reflection?

This step reminds you to reflect and question. Are you progressing, improving, staying disciplined? If not, what will you adjust going forward?

Final thoughts

Checking your trades daily is important but adding this 15 minute, 4-step weekly review allows you to recap your progress, spot patterns, and improve.

To recap:

– Use the analytics dashboard to look at your trade performance metrics

– Utilise your P&L calendar to catch emerging trends

– Use your journal to tag setups, add screenshots, and reflect on your past wins and losses

– Leverage the leaderboard to benchmark your consistency and enjoy a bit of friendly competition

Whether you're a beginner or a seasoned trader, this 4-step review process will help you stay focused, accountable, and strategic without overthinking it.