Track Your Trading Mistakes (Before They Cost You Big)

TraderWaves Team • 15 April 2025 • 6 min read

Why Not Tracking Performance Costs You

Logging your trades isn’t just about keeping records, it’s about tracking your habits. Every trade you log builds a clearer picture of how you actually behave in the market. Are you overtrading after a win? Risking too much on certain setups? Entering too early when you're uncertain?

When you track your trades, whether it is in a notebook, spreadsheet or trade journal, you’re also tracking the behaviors that shape your performance. Metrics like win rate, risk/reward ratio, and time of day are helpful, but the real insight comes from spotting your own patterns. These patterns in your trading begin to emerge over time, letting you know what’s making you money and what needs to change. This is especially valuable if you’re a beginner or testing something new. You don’t need to trade blind, your own data will tell you where you are going right (and wrong).

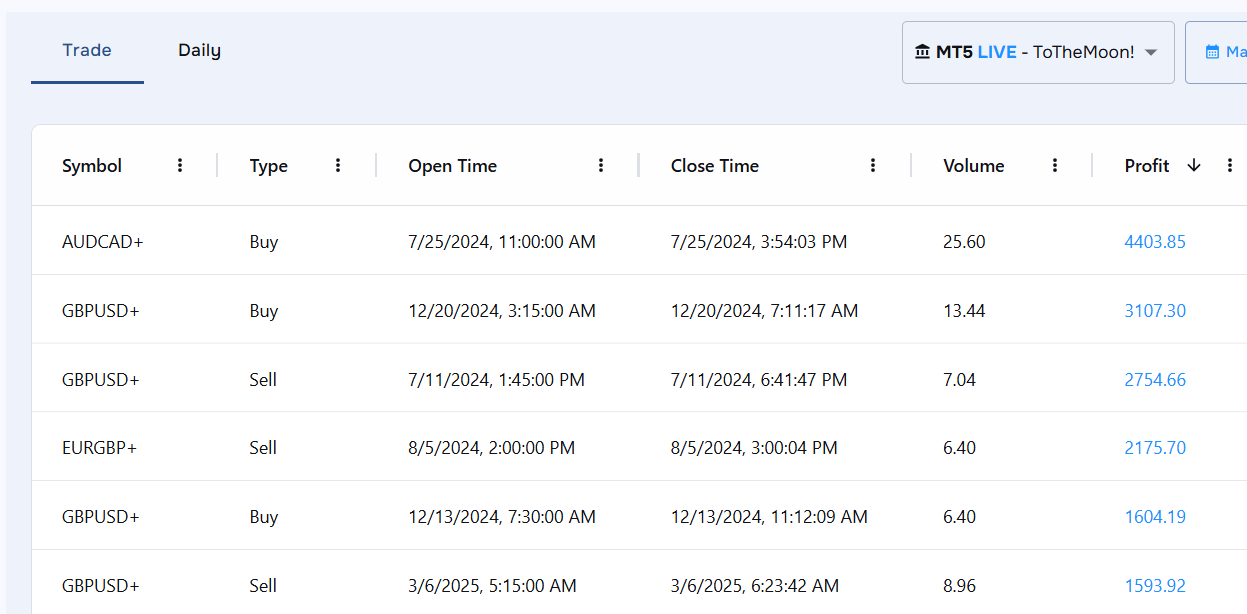

View of a Trade journal

Key takeaway: Performance tracking is also a form of habit tracking. To grow as a trader, you need to understand your decisions, not just your outcomes.

5 Common Trading Mistakes

Making mistakes is normal in trading, whether you are just starting out your journey or you are a seasoned pro. Sometimes, the decisions that impact your trading results the most are the ones you don’t even realise you’re making. Your timing might be slightly off, you took more risk than you normally would have these are what we’d call technical errors. They’re rooted in execution, like selecting the wrong volume size or skipping steps in your setup.

Here are 5 common technical trading mistakes that slowly eat into your profits:

– Risking too much on a single trade

– Ignoring or adjusting stop losses

– Entering without a clear setup or reason

– Switching strategies too quickly

– Failing to log the reason for each trade

Without a proper system to track trading mistakes and flag them, they can become ingrained sometimes as bad habits, sometimes even as happy accidents that reinforce poor decisions (like getting lucky on a bad trade). For example, you might have played around with different position sizes in the past, increasing or decreasing volume based on instinct. But once you start logging your trades, you realise that your mid-sized positions are consistently delivering better returns, while the larger ones underperform. What a mistake not to have spotted that earlier, that’s money left on the table! Or take risk management: you might find that you're consistently risking more than your intended percentage per trade, slowly throwing off your strategy without even knowing it. These patterns stay hidden until you track them.

There are countless variables at play in trading: strategy, setup, market conditions, time of day, risk exposure. That’s exactly why it’s so important to take control of the parts you can influence and that’s where performance really starts to improve.

Key Takeaway: You can’t control the market but you can log your habits. Tracking common mistakes is one of the fastest ways to turn inconsistent trading into consistent progress.

Emotional Mistakes and Psychological Triggers

While technical errors can appear isolated, they’re often the surface-level result of deeper behavioural patterns. Take this example: you notice that you risked far more than usual on a single trade (which is definitely outside your trade plan). When you investigate the cause you uncover that it was a revenge trade, triggered by the frustration of a previous loss that day. That emotional reaction leads to poor judgment, and just like that, you’ve kick-started a losing streak.

Here are 5 common emotional trading errors:

– Revenge trading after a loss

– Overtrading after a big win

– Panic exits when trades move against you

– FOMO-driven entries that don’t match your strategy

– Moving your stop loss when you can’t accept a loss

Correcting trading psychology mistakes are just as important as fixing technical ones. Especially as many technical errors are caused by emotional decisions. Tagging emotional triggers, overtrading habits, and psychological missteps in your trade journal is one of the simplest ways to monitor your mindset. By keeping a log of these emotional trading mistakes not just technical errors, it allows you to stay accountable for your decision making. Your strategy may be sound but if your execution is rooted in emotion rather than logic, you won’t be able to trust your results. If you can’t trust your results, how can you know if your strategy even works? Tracking the context behind each trade is the only way to be sure.

Key Takeaway: With a dedicated trading mistake tracker, you can tag each mistake, review them later, and start to see which errors repeat most often. Over time, that awareness builds into consistency.

The Best Trade Tracking Software (That you’ll actually use)

You don’t need a generic spreadsheet, a clunky CSV export, or yet another overcomplicated dashboard to log your trade day. Many trade journals have useful features but are locked behind a paywall, while the free alternatives, like Excel or Notion, aren’t built with traders in mind. The best habit tracking tool is one that you actually use.

We built TraderWaves to be a free trading habit tracker designed with real traders in mind. We believe that tracking your trades shouldn’t feel like a chore. Our trade journal focuses on what actually improves your performance: spotting habits, tagging emotional triggers, and tracking setup quality. Inconsistency in logging trades leads to gaps in your data, and you and I both know the trades you don’t log are usually the ones you should! That’s why our journal tagging system makes it easy to quickly log your performance for any given day.

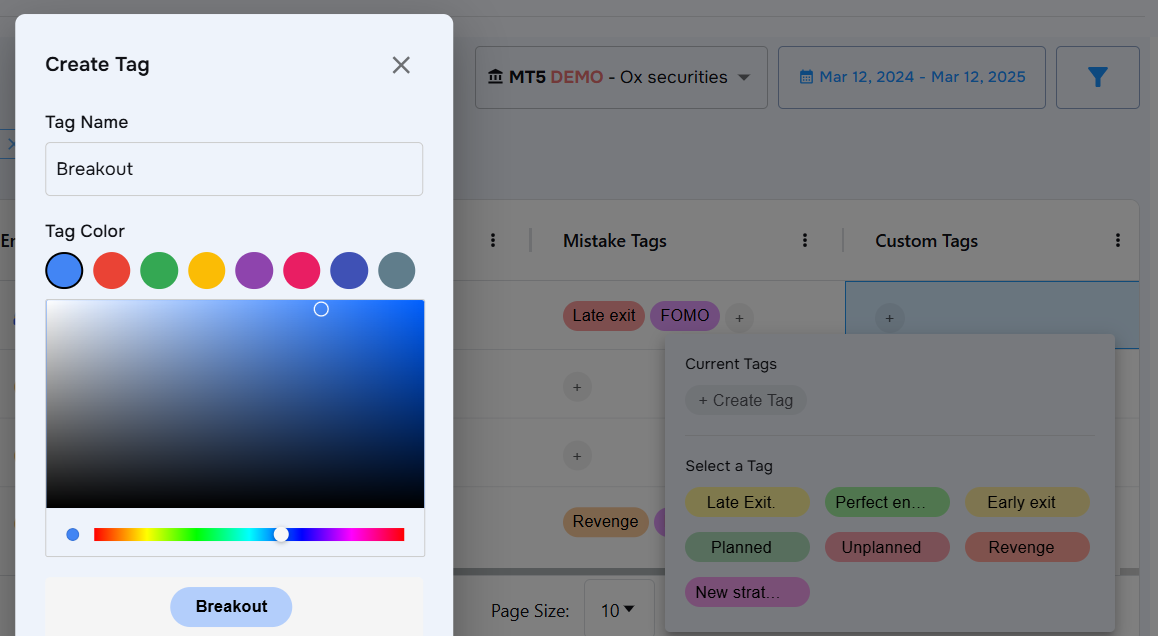

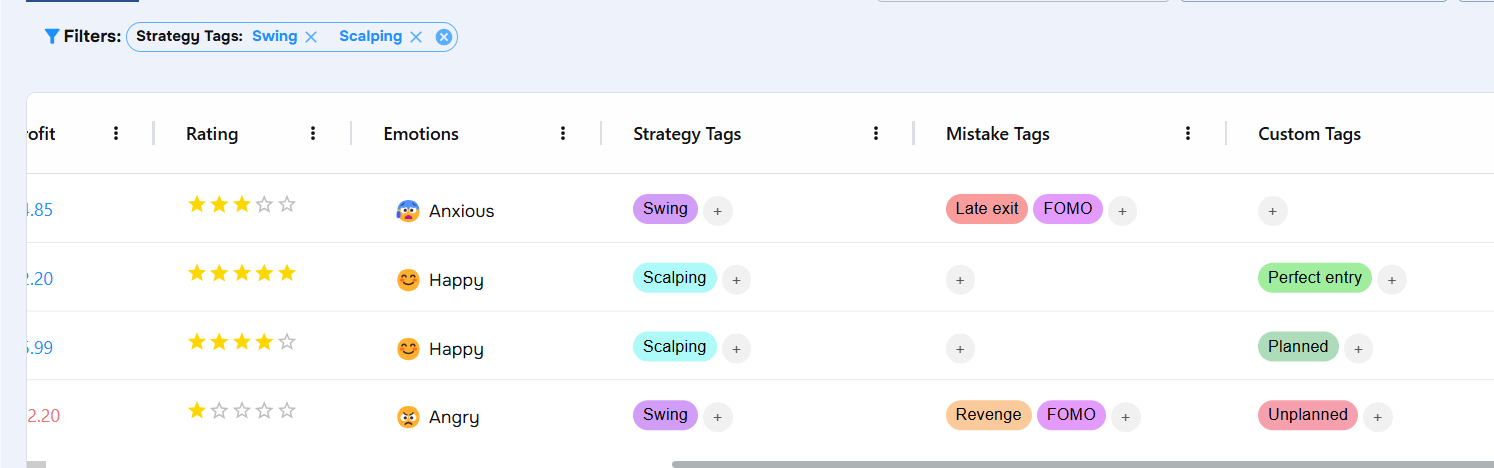

Screenshot of the TraderWaves tagging system.

You can simply tag each trade with key elements like setup type, execution rating, confidence level, and trade quality. Beyond that you can also track mistakes (like "overtrading" or "moved stop loss") and psychological patterns (like “felt rushed” or “acted on fear”). You can even create custom tags to track whatever matters to you. When you’re ready to review, simply filter your trades by tag to spot patterns fast. You’ll see exactly which bad habits you need to stamp out and which setups are consistently working in your favor.

A clear view of your trade tracking dashboard.

Key Takeaway: The best trade tracker is the one you’ll actually use. When it’s simple to log trades and easy to spot patterns, tracking becomes a habit and that’s when real improvement starts.

Conclusion

In trading, it’s often the habits you don’t notice that cost you the most. Whether the trading mistake is technical like switching strategies too soon or psychological like placing a revenge trade, they can stifle your progress. If not caught early, a one-time mistake becomes a bad habit. The only way to spot (and to ultimately improve) is to track them. By using a trade habit tracker, you can start to see what’s working and what isn’t. Tracking is not just about numbers. It’s about becoming a more aware, more consistent, and ultimately more effective trader.

Check out our free trading habit tracker for yourself.