Become Your Own Trading Psychology Mentor

TraderWaves Team • 10 June 2025 • 5 min read

Tendler’s Method: Map → Understand → Fix

Jared Tendler, in his book The Mental Game of Trading, highlights a key insight: emotions aren’t the problem. How can this be when all the trading advice that you hear is to silence your emotions? He points out that we are not robots! It is not realistic to tune out all emotions, it is expected that you will feel excited after a big win or frustrated after a loss. Emotions and mindset don’t have to hold you back, he uses the example of pro athletes using anger to fuel their performance. The difference is that these athletes are in control and know how to use emotion to their advantage. According to Tendler, the real issue that is holding your trading back is pattern recognition.

His solution? Map the patterns. Make a note of the 5 W’s: what emotion, when it happened, why, what triggered it, and what followed. Your trade journal might currently be a dumping ground for rants after a bad trade. However, your journal can be so much more: a tool for data collection, pattern recognition, and personal growth. By treating journaling as another trade analysis tool, you can identify the true cause of the problem not just the symptoms.

Track in the Moment: Tag Triggers, Not Just Trades

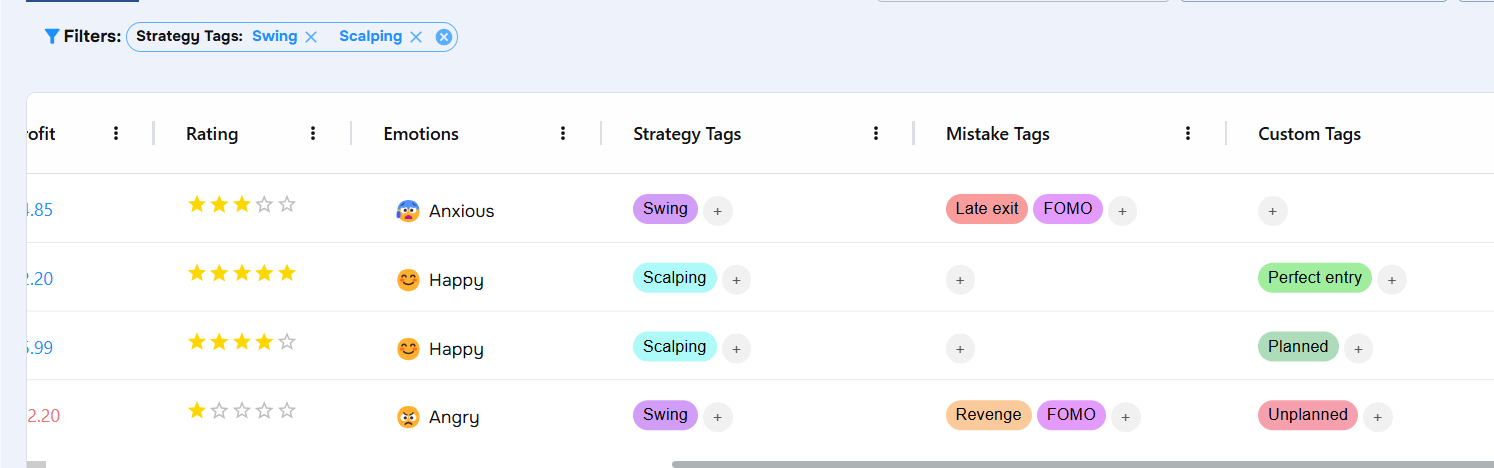

To capture the most accurate and meaningful data, journal in the moment. Waiting until the end of a trade day, after placing 20+ trades, often leads to gaps. Journaling in the moment means having a speedy method to add trade data. Using pre-made tags is a quick way to keep track of key trade details. Mistake tags might include things like "No plan", "Revenge Trade", or "FOMO". Spotting emotional triggers in real time helps you catch bad patterns before they spiral. Tendler calls this the micro-level of your mindset map.

To catch these triggers you can:

– Assign mindset tags (e.g., angry, excited, bored…)

– Add mistake tags (e.g., FOMO, Revenge trade…)

– Track if you followed your plan and how you felt during execution.

TraderWaves tagging for trading mindset

For even deeper analysis:

– Add trade notes like: “Didn’t trust the setup, entered too early.”

– Upload a screenshots of your trades.

The most important part is to develop a disciplined routine. Having a trade journal that helps you build this habit rather than hinder it. If adding trades is automated and it is easy to add quick notes to trades, it makes the habit easier to build and you are more likely to stick with it. Journaling this way is the ideal way to map your patterns not at the end of a long week, where you have forgotten all the details, but in the moment.

Macro mindset patterns: PnL calendars, charts, and other tools

Reviewing isn’t just for trade performance metrics, it is also essential for mindset awareness. This is the macro level of the mindset map, identifying overarching patterns across your trade log. Carving out some time each week to go through your past trades and trade logs.

Look for:

– Recurring emotions after similar outcomes

– Reactions that tend to follow red days

– Setups that cause hesitation or overconfidence

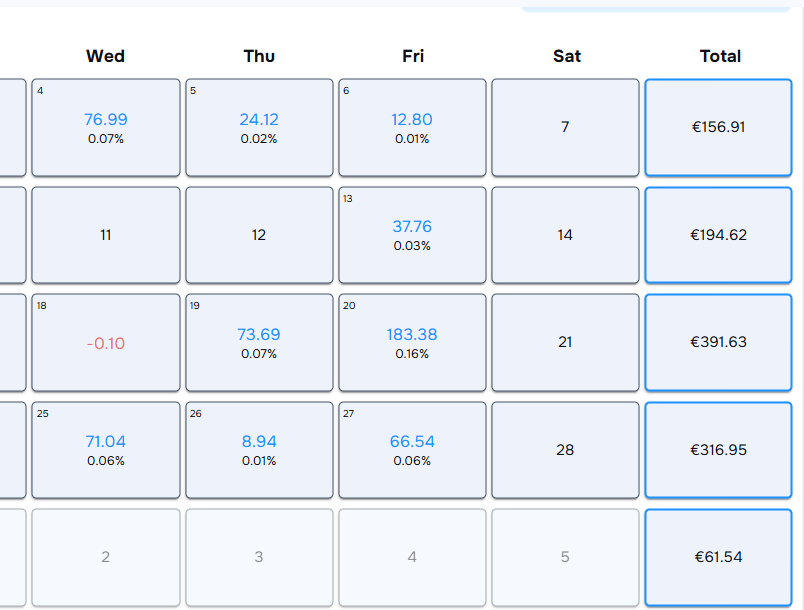

Your journal is only the start to analysing trading psychology there are other tools that also reveal the patterns. Your PnL calendar is a prime example.

TraderWaves PnL Calendar for spotting macro mindset patterns

Seeing how your month progresses on a calendar helps you spot patterns you wouldn’t catch in daily journaling alone. The PnL calendar visualises how your trading mindset evolves over days, weeks, and months. Ask yourself questions like: Do red days lead to revenge trades? Does a green streak create riskier behaviour? Do certain weekdays show better or worse execution?

At the end of the day, accepting losses as part of the game is key to progress. Red days will happen but stopping a cycle before it starts will change your future trading outcomes. Combining the micro-journaling with macro stats provides you with the complete map your your mindset. Holding a mirror to your trade log allows for true reflection and accountability comes from the why behind outcomes.

Want help with weekly review structure? Check out this blog

Adjust the Mental Game Plan

Spotting these patterns is the first step in responding to emotional trading habits. When you know what the problem is, then you can begin to fix it. Tendler talks about finding the balance between awareness your emotions and the ability to regain control. It can be broken down into: Identify, acknowledge, control. You begin by identifying what the problem is, knowing when it happens (the situations it arises). To correct your mental/emotional reaction requires having the right logic and ensuring it is strong enough to disrupt the pattern. When you know what emotional reactions are likely, you can put safeguards in place:

– Size down on tilt-prone days

– Use a pre-trade checklist to combat hesitation

– Add a mandatory pause rule after a big win to avoid overconfidence

Reaching resolution, as Tendler put it, is the result of correcting this ‘bad habit’ until the correction is the new habit. Over time, you’ll build mental habits that replace impulsive reactions with confident decisions. It becomes second nature to apply the ‘correcting’ habit.

Conclusion

Trading psychology isn’t about removing emotions, it’s about recognising them and adjusting your strategy accordingly. The more aware you become, the better decisions you’ll make. By using tools to track your emotional patterns, journaling in the moment, and reviewing weekly, you’re not just logging what happened, you’re spotting the problems before they become bad trading habits. However, patience and mental discipline are key here. This is the toughest part of the journey but for something that makes up 80% of your trading success, investing in your psychology is a no-brainer.

Learn more about what a free trade journal can do for your trading performance.