Trading Plans: Why They Matter (And How to Stick to Yours)

TraderWaves Team • 1 April 2025 • 7 min read

1. Why Trading Without a Plan is a Recipe for Failure

Without a trade plan, you are really trading blind. How can you know what to aim for if you don’t have a plan? You can’t really know how to achieve your trading goals or what is helping you become profitable. These habits lead to inconsistent trading results:

– Overtrading – Taking too many low-quality setups, leading to unnecessary losses.

– Emotional trading – Revenge trading after a loss, taking impulsive trades out of boredom.

– Strategy changes – One day you’re scalping, the next day you’re swing trading.

– Impulsive entries – Trading without proper setup confirmation or planning, often due to FOMO.

Successful traders don’t trade without a game plan. They know that to be profitable, you need clear rules, consistent tracking, and ongoing refinement of your strategy. Various factors can impact your trade, so knowing what is helping and what is not is crucial to improving your trading game.

Key takeaway: Most traders underperform because they take unplanned trades, which often have lower probabilities of success.

2. What Does a Good Trading Plan Include?

Knowing you need a plan is one thing but putting one into action is another! There are some key things that should exist in any good trading plan:

– Entry & exit rules to define your trade boundaries and avoid emotional decisions.

– Position sizing & risk limits to protect your account and manage drawdowns.

– Preferred market conditions like session times, volatility levels, and trending vs. ranging setups.

– Clear trade setups that match your strategy and keep your entries consistent.

A trading plan with clear entry/exit rules, risk management, market conditions, and defined setups helps you eliminate emotional decision-making and stay focused on consistency. These features work together to create structure, reduce impulsive trades, and ensure you're only taking high-quality setups that align with your strategy.

Key takeaway: Trading plans remove the guesswork and emotions from trading allowing you to focus on execution rather than making decisions on the spot.

3. The Power of Sticking to a Trading Plan

Once you have a trade plan, it becomes much easier to maintain discipline. You can become more consistent and confident in your trading allowing you to tweak your setup or increase your position size over time. Experienced traders use their plan not only to stay on track of their trading performance but also to refine it. They can refine their setup, update their risk management rules based on current market conditions or their own performance data.

.png)

Having a trade analytics tool and a trade journal can allow you to utilise your data to improve. If you notice that your unplanned trades are consistently less profitable, or that you’re exiting too early on winning trades, then this allows you to make deliberate changes based on fact, not feeling. When it comes to scaling you might start automating parts of your system. A clear plan provides a blueprint that can be tested, refined, and followed, whether you're using an algorithm or a copy trader to replicate your successful strategies across different accounts.

Key takeaway: Not just having a plan but sticking to it is crucial for consistency, refinement and long-term profitability.

4. How to Track If You're Sticking to Your Plan Using TraderWaves

It is easy to create a trade plan but sticking to it is where most traders struggle. If you are not making note of when you are following your trade plan then, how can you know if it’s working?

Using a trade journal can be a helpful way to know if you are being consistent with your trade plan. However, many traders who start consistently logging trades in trade journals soon stop. The problem is that journaling can be time-consuming, especially if there is a lot of manual data entry. It is much easier to stay consistent and disciplined when the process is effortless. Instead of manual entry, opt for an automatic import trade journal like TraderWaves . The TraderWaves trade journal also has a tagging system that allows you to quickly add tags to your trades for that day so you can focus on reviewing insights, not inputting data.

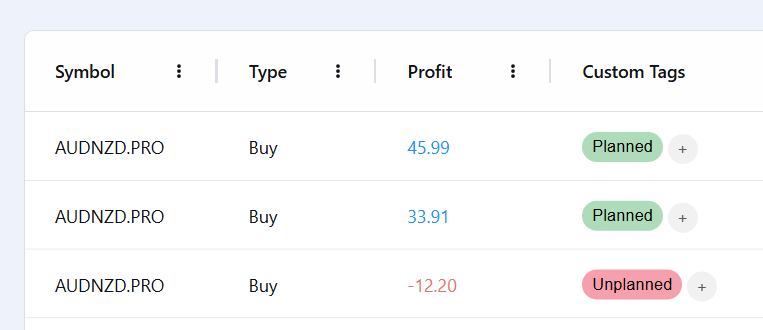

Fig 1: Tagging planned vs unplanned trades in journal

One great way to use the TraderWaves trade journal is to tag each trade as "Planned" or "Unplanned." The "Planned" tag refers to trades where you followed your trade plan and its pre-defined rules. An "Unplanned" trade refers to trades made impulsively, outside of the plan. By consistently tracking these tags over time, you can compare performance and see how much money unplanned trades may be costing you. For example, if Planned trades have a 60% win rate but Unplanned trades only win 30% of the time, then it’s clear that sticking to your plan improves your profitability.

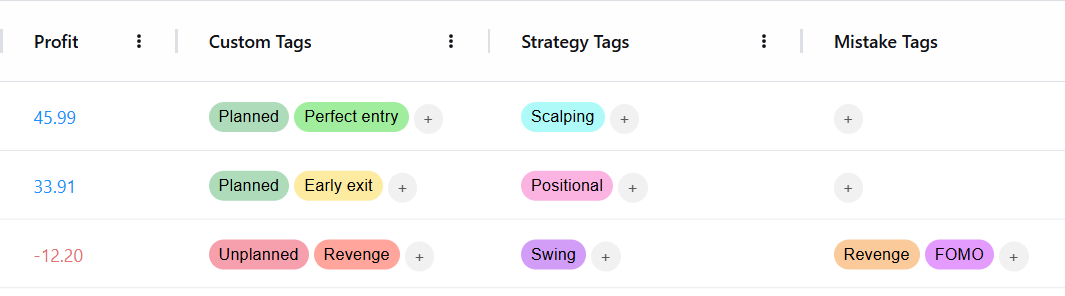

Fig 2: Tagging mistakes, execution, and strategies for trades in journal

When it comes to refining your setup, the devil is in the details. Your strategy might be effective, but if you’re not tracking how you're executing it, you could be missing the real issue. For example, early exits, not the setup itself, might be what’s hurting your profitability. To avoid missing any crucial details, you can create your own custom tag for what you want to track e.g. tag your trade entry/ exit execution. The TraderWaves trade journal also has built-in tags such as, trade ranking, trade strategy, and emotional tags.

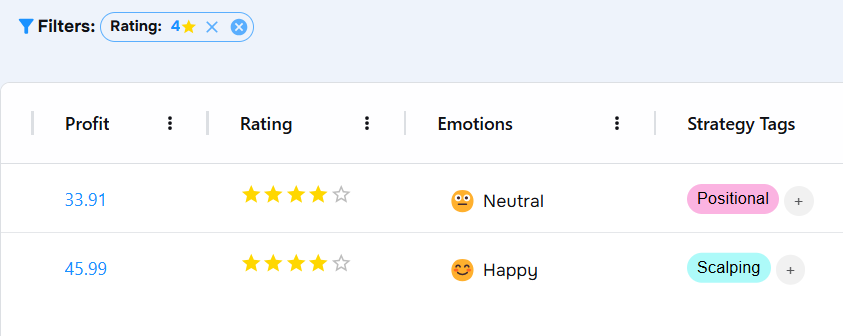

Fig 3: Filter by trade rating and add emotional tags in Trade Log

Emotional tags, such as being bored or angry, allow you to monitor how your trading psychology impacts your trade outcome. The TraderWaves trade journal also allows you to filter by all your tags, making it easy to compare whether Scalping or Positional trading is more profitable based on your own trading style. Our trade journal simplifies your data analysis. When it comes time to refine your trade plan, you can filter through your tags and review which strategies, setups, and trading habits are truly driving your performance.

Key takeaway: You can’t improve what you don’t track. Journaling with TraderWaves helps you spot what’s working, what’s not, and whether you’re truly following your trade plan, giving you the data you need to trade smarter and more consistently.

5. How to Improve Your Trade Plan (Using Data)

Once you have been following your trade plan for some time, you should be able to see if it is working for you and if there are ways to increase your profitability. Knowing how often to make these changes can be difficult. Some traders change their setup and strategy too often to see if it is really making a difference in their trading.

As a general rule of thumb, gather enough data to evaluate your current plan and make small revisions. For larger changes, like swapping your core strategy or trading style, this should be reviewed around every 3–6 months to ensure you have enough consistent data to review. Staying adaptable is important, but this approach ensures your adjustments are based on real insights, not reactive changes driven by short-term emotion. The flowchart below can help you determine when and how to tweak your trade plan.

.png)

There are two key ways to analyse your trade data. The first is by monitoring your trade statistics, such as your win rate, monthly profit, and trade count. These graphs and charts help you visualise your account performance over time. The second is by looking at your execution and consistency data which is being recorded in your trade journal when you log your planned vs unplanned trades alongside your other trade tags.

Both are valuable but provide very different insights. For example, your balance graph might be slowly declining, so you might decide to ditch your current trade plan based on this. However, your trade journal might actually show that your planned trades are profitable, it is your unplanned trades that are bringing your balance down. Hence the importance of looking at all your data and logging the reasons behind the trade. The issue here wasn’t the strategy, it was inconsistency in execution.

Key takeaway: Your trade stats show how you're performing. Your journal shows why. You need both to make informed improvements.

Conclusion

A Trade Plan is more than a checklist, it is essential for all trades to build consistency, avoiding emotional decisions, and improving trade performance. Here, we have explored why a trade plan matters and what a solid one should include. We also highlighted how consistency is key, not just in sticking to your plan when placing trades, but in consistently logging whether you followed it in your trade journal. By tagging your trades, your journal data can reveal whether it’s your trading habits or emotions holding you back or whether it’s your trade plan execution that needs refining. TraderWaves gives you the tools to do this. With features like trade tagging, execution notes, and performance analysis, you can measure not just what your results are… but why you’re getting them.

Your challenge: For the next 30 days, tag each trade as Planned or Unplanned. Review the data and see the difference a disciplined plan can make.