Best Times to Trade Forex

TraderWaves Team • 5 February 2025 • 5 min read

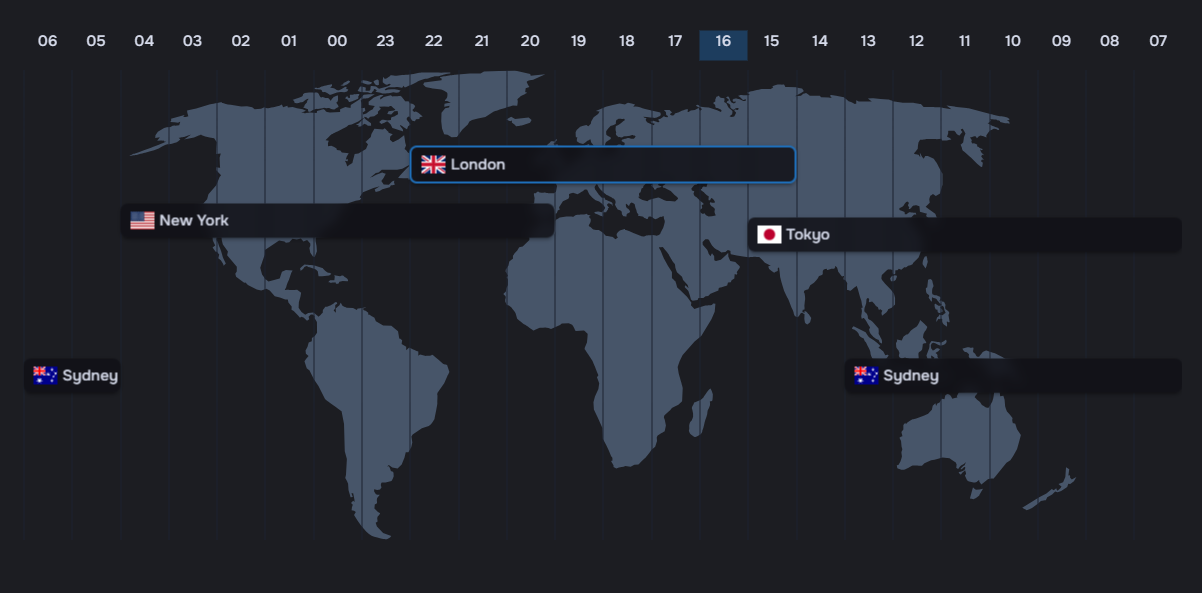

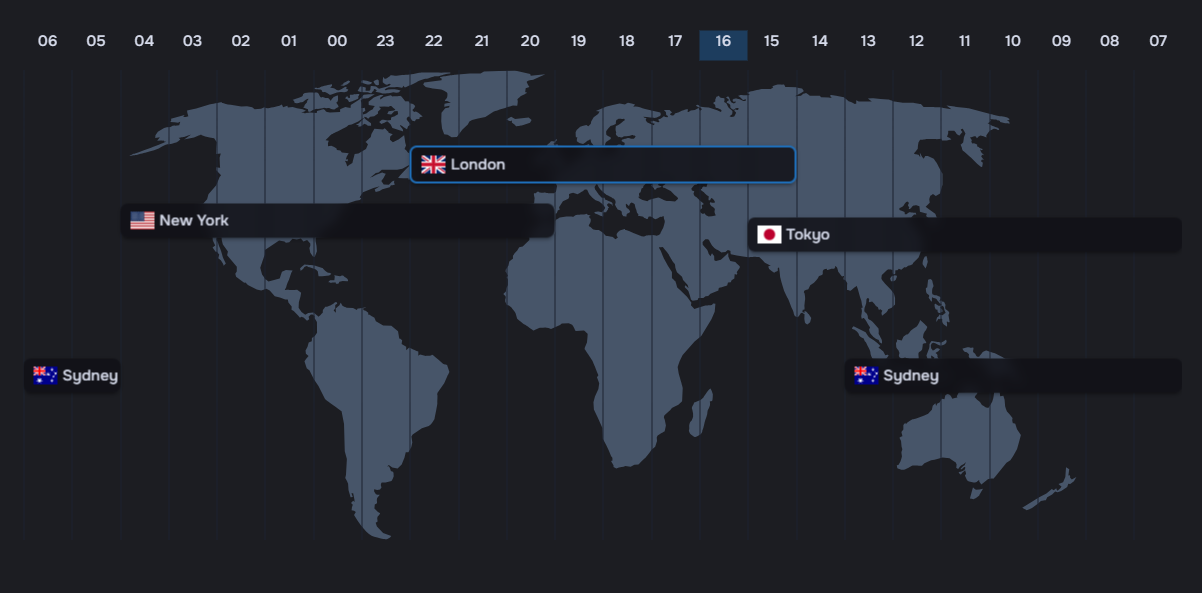

1. When are the Forex Market Hours?

The forex market hours can be divided into four main trading sessions: Sydney, Tokyo, London, and New York. The London and New York session overlap is the most significant, lasting 4 hours.

With different time zones and daylight saving time shifts, knowing exactly when sessions open and close can be tricky. Instead of memorizing forex trading hours, use the TraderWaves Forex Market Session Map to determine when the markets are open, helping you execute trades at the best moments.

Key takeaway: By using a Market Sessions map, you ensure you know when the sessions are open and your optimal times to trade.

Fig 1: Major trading sessions and their time zones.

2. Why Does Timing Matter in Forex Trading?

In forex trading, timing can be the difference between a profit and a loss. More active markets, where there is high trade volume, mean more buyers and sellers executing orders. This increased liquidity results in trades being executed more quickly and at prices closer to the expected value, reducing the risk of price gaps.

Trading outside of these high-liquidity periods hurts your chances of securing profitable trades, as liquidity is lower, spreads are wider, and slippage is increased. In short, ensure relevant markets for your pair are open and active for the best trading results.

Key takeaway: Timing your trades with relevant market sessions helps secure better execution, lower slippage, and tighter spreads by trading when liquidity is highest and price gaps are minimal.

3. Forex Session Overlaps: To Trade or To Wait?

Session overlaps are generally the best trading periods for forex traders. The London and New York session forex overlap offers the highest trade volume; this peak activity makes it an ideal time to participate in trading, especially for USD pairs (e.g., EUR/USD, GBP/USD, USD/CHF). The fastest way to determine your ideal trading window is to check with a Forex Market Session Tool.

As a general rule of thumb, it's best to trade pairs when the session aligns with the currencies in the pair. For example, AUD/JPY sees the highest trading volume during the Sydney-Tokyo overlap when both the Australian and Japanese markets are active. That said, even if it's the best trading window for your pair, trading the London-New York overlap from Australia—timing is nothing without focus. Trading sleep for currency pairs isn't exactly a winning strategy.

Key takeaway: Generally, overlaps are the best time to trade, so if you can, wait. The London and New York session forex overlap is the most active, ideal for pairs of those time zones.

Fig 2: The most active trading overlaps for better trade execution.

4. How to Trade with the Forex Market Session Map?

Now that you understand the significance of the forex trading sessions, the next step is to stop the guesswork and trade with precision. The Forex Market Session Map, available in the TraderWaves FREE customizable stats dashboard, provides a clear view of real-time market hours, overlaps, and the best times to trade.

One of the most powerful features of the Forex Market Session Map is that it automatically aligns to your timezone. This means you can instantly see which markets are open and when, without needing to manually convert time zones. Now you can stay in sync with global trading hours effortlessly.

Combining the Forex Market Session Map with real-time analytics and trade journaling allows you to track your timing and never miss an optimal trade opportunity.

Key takeaway: Rather than guessing forex trading hours, use the TraderWaves Market Session Map to trade at the best time, every time. Try it for free today!

Fig 3: TraderWaves widget viewing London session times.

5. How Do Market Sessions Impact Trade Strategy?

By now, you know that trading during certain forex trading sessions can impact the liquidity of currency pairs and your success. Some strategies are more affected by market sessions than others. For day traders, liquidity is key for profitable trades relying on fast-moving markets. In contrast, position traders holding long-term trades find daily sessions less critical, but it can still affect trade entry/exits.

Key takeaway: No matter your trading strategy, understanding session-based price movements helps in timing your trades better.

6. Times to Avoid Trading

Not all market hours are equally profitable, and some trading windows pose higher risks due to low liquidity and unpredictable price movements. Here are key times to avoid trading forex:

New York Lunch Hour: From 12 PM to 1 PM EST New York traders are not active, and it's also the end of the overlap with the London session. Liquidity drops, spreads widen, and price movements become choppy.

The London Fix: The 'London Fix' is a daily event where currency prices for commercial transactions are set, resulting in a surge in trading activity 30 minutes before the 'fix'. After 4 PM GMT, there's an abrupt drop in liquidity, which can cause erratic price movements or slow market activity, posing risks for beginners.

Weekends and Holiday Trading: Traders tend to close their positions on Friday in anticipation of the market closing over the weekend, causing price swings. Sunday market openings can also see gaps due to weekend news events.

Key takeaway: Even within 'optimal trading times,' there are still less optimal and riskier periods to trade. Avoid these high-risk windows to improve trade execution and reduce unnecessary losses.

Fig 4: Major trading sessions and their time zones.

Conclusion

Timing is everything in forex trading. While the market operates 24/5, not all hours offer the same profit opportunities. Trading during overlaps offers high liquidity sessions, leading to better execution and lower slippage. In contrast, trading during low-volume hours—such as the New York lunch hour or weekends—can result in wider spreads and increased volatility.

To ensure you're trading at the best times, use the TraderWaves Forex Market Session Map. It helps you pinpoint active forex trading sessions, identify overlaps, and plan your trades accordingly.

Check out the TraderWaves Dashboard for more features like this Join free

Frequently Asked Questions

- Sydney is open from 9:00 pm to 6:00 am UTC

- Tokyo is open from 12:00 am to 9:00 am UTC

- London is open from 7:00 am to 4:00 pm UTC

- New York is open from 1:00 pm to 10:00 pm UTC

- London - New York: 12:00 PM – 4:00 PM UTC

- London - Tokyo: 7:00 AM – 8:00 AM UTC

- Sydney - Tokyo: 9:00 PM – 12:00 AM UTC

- New York - Sydney: 10:00 PM – 12:00 AM UTC