Still Not Improving? The Trading Habit You Are Missing

TraderWaves Team • 16 July 2025 • 7 min read

With all the advice that other traders have to offer, from Twitter threads to trading forums, it’s easy to feel overwhelmed. You’re doing everything they say to do, but your profitability doesn’t reflect your effort. Simplicity is key. What if one simple habit could fix 90% of your trading issues? This blog introduces the one weekly habit that separates struggling traders from consistently improving ones.

Scrapping the Old Advice

Some trading advice is hyper-specific: "Don’t use moving averages for entries."Other advice is so vague it’s meaningless: "Be disciplined." or "Stay consistent." But that raises the question: Disciplined with what? Consistent in what exactly?

Why this advice doesn’t work:

1. You often only learn by doing. That ultra-specific advice might work but, until you make the mistake yourself, it probably won’t stick.

2. It’s not actionable. Telling someone to “stay accountable” sounds intelligent, but what are you actually supposed to do? How do you measure that?

3. Mistaking knowledge for performance. You can read every trading book under the sun, but there’s no quiz to sit. Success comes not from what you know, but how well you put it into action.

So if none of that advice is helping, what actually will?

One Weekly Habit to Rule Them All

Here’s where most traders go wrong: They try to fix everything at once. But trying to change 20 habits at the same time usually leads to burnout or confusion. You end up slipping back into old patterns, and worst of all you’re not even sure which change would’ve made the real difference.

That's why it's best to build this habit: Asking yourself “Did I Follow My System or Not?”. Told you it was simple! By our definition, your system covers everything from pre-trade to post-trade. That includes having a plan before entering a trade and a structured way of reviewing that trade afterward. Following your plan in the moment is one part, the other is using the same review process, with consistent depth and frequency. Writing “Placed a trade, it made money” every time might be consistent… but it’s not helpful. For true improvement, put the same level of thought into each post-trade analysis.

What Your Answer Really Means

Asking the question, "Did I Follow My System or Not?" every time you do your trade review provides a simple way of assessing your trading consistency overall. There are three possible outcomes:

If you answered ‘No’

It is all well and good to have a system, but if you aren’t following it, you won’t know if it works or worse, you’ll wrongly blame it for poor results. One of the most common beginner mistakes is not having a trading plan. If you don’t have a trade plan, every trade becomes a guess. When it comes to reviewing, without a trade plan, you will have no baseline to improve from and no data to learn from. Want to learn more about trade plans?

If you answered ‘Yes’

If your journal shows clear evidence that you’ve been sticking to your trade plan and reviewing trades with consistent depth, then you can confidently say you’ve been following your system. That’s a good thing: now you have direction. The issue is less about how you're executing and more likely about your system itself. Whether that’s your entry criteria, strategy, risk rules, or the timing of your trades.

A drop in performance might also be influenced by market conditions, but if you’re seeing underperformance across a longer period, it’s probably not just a one-off bad day — it’s a system-related issue. Before you blame your strategy though, make sure you’ve followed it across enough trades to fairly evaluate it.

If you answered ‘Sometimes’

This is the usual response to this question. One week you make detailed journal entries, but the next you don’t, or at the start of the day you stick to your trade plan but by the end of the day, you’re placing revenge trades. This is probably what the advice ‘Be consistent’ is referring to. When you aren’t consistent, it is even harder to know what is working for you or why things might be going wrong.

Whatever your answer is to the question, this one habit acts as a diagnostic tool, keeping you on course before small issues become full-blown account killers.

Why This Habit Works Like a Multiplier

Most bad trading habits don’t stem from poor strategy, they come from repeated errors. By asking yourself “Did I Follow My System or Not?” you can see when you traded when you shouldn’t have, or maybe risked more than you intended to. This trading habit reveals your trading mistakes and forces you to stay accountable. Common trading mistakes that can be identified with this one habit:

🔹 Overtrading / FOMO

→ “I felt like I had to catch the move.”

Did you follow your system: NO. You didn’t follow your trade plan. In your review process, you can monitor the mistake with a trade tag like “not in plan.” This way you can track this mistake and over time, you stop chasing.

🔹 Poor Risk Management

→ “I moved my stop because it was ‘almost there.’”

Did you follow your system: NO. You went against your trade plan by changing your stop loss. Make a note of this in your journal to see if there is a pattern.

🔹 No Structure / Random Entries

→ “I kind of freestyled this trade.”

Did you follow your system: Maybe? You might think you followed your trade plan but, without consistent notes, how can you be sure? Building the habit of following your system ensures your entries are meaningful for future analysis.

Trading improvement starts with recognition of bad habits. During your weekly trading post-mortem, you will begin to see the patterns and then you know exactly which bad trading habits are tanking your results. Improving trading behaviour doesn’t happen overnight but the golden habit is the starting point for consistency, accountability, and discipline.

Tools To Build THAT Trade Habit

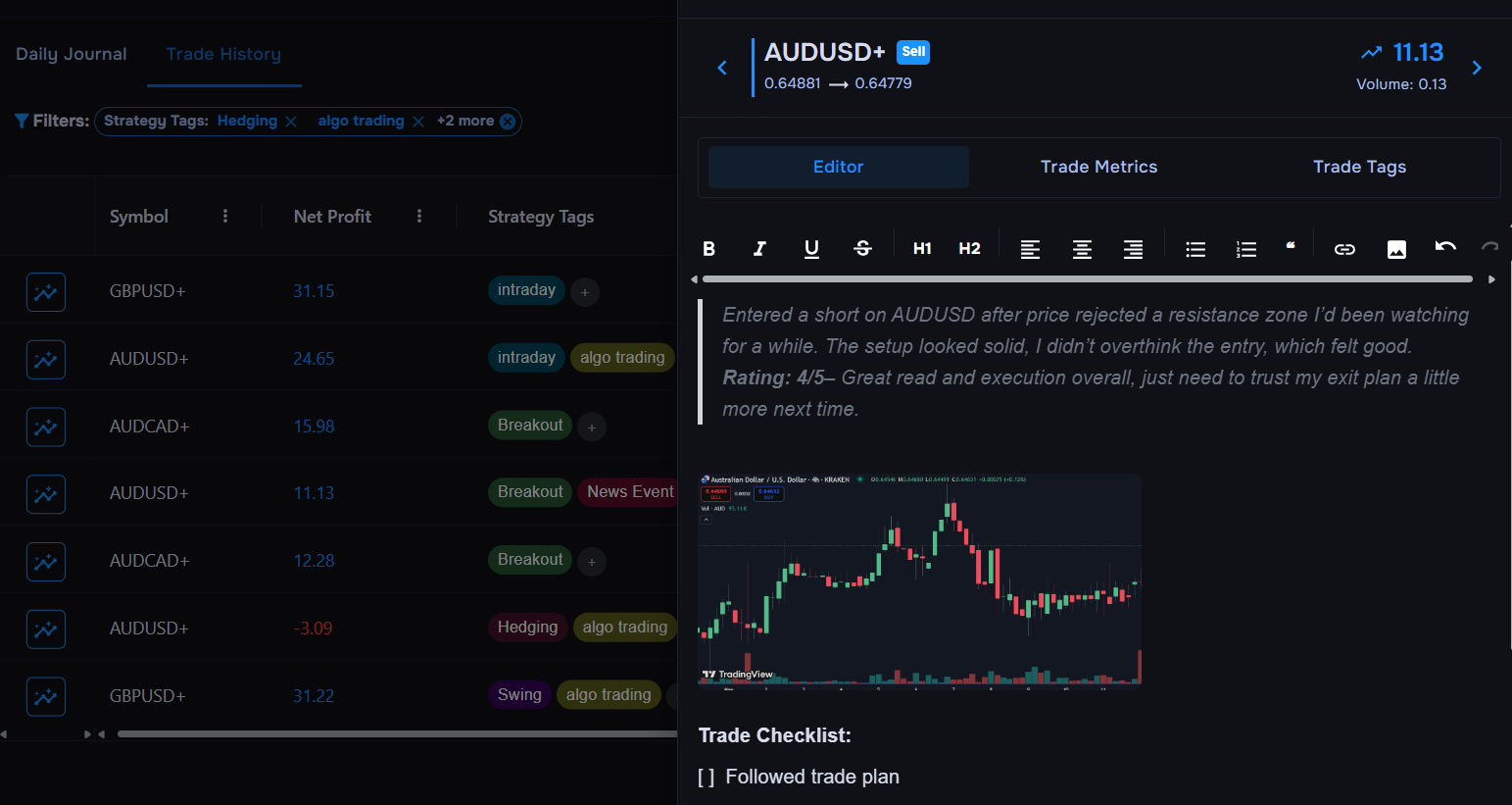

Creating this habit doesn't have to be complicated. There are trading tools that can help you to build your system and to help you know you have followed it.

🔹 Trade Journal: Use your journal before and after each trade. Write out your trade plan ahead of time (including your setup, entry, stop, and strategy), then review your execution afterwards. This is also where you track whether you followed your system or not.

🔹 Trade Tags: Add tags like "FOMO," "revenge," or "off-plan" to your trades. This helps you spot repeated mistakes and makes it easier to evaluate your plan and trading behaviour over time. 🔹 PnL Calendar: A colour-coded calendar gives you a quick view of your weekly performance. Combine it with your trade tags to spot patterns (e.g. do certain mistakes always happen on Mondays?).

🔹 PnL Calendar: A colour-coded calendar gives you a quick view of your weekly performance. Combine it with your trade tags to spot patterns (e.g. do certain mistakes always happen on Mondays?).

🔹 Statistical Dashboard: Charts and graphs make your trading progress visual. Use stats like win rate, average holding time, and biggest win/loss days to understand what's working and where to improve.

Looking for a simple way to track all of this in one place? Try our free trade journal and stats platform

From One Habit to Long-Term Growth

This habit is simple, but it works hard.

Asking “Did I Follow My System or Not?” helps you see clearly whether your actions match your intentions. It gives you a way to spot problems, take accountability, and actually see if you’re improving. Over time, this one habit helps you figure out whether the issue is your trading plan or how you’re sticking to it.

It also gives you a way to track what’s working. Just like a good scientist tests a theory, you test your system. Even if you're doing well, you can see what’s driving those results. In trading, being able to repeat what works is how you grow.