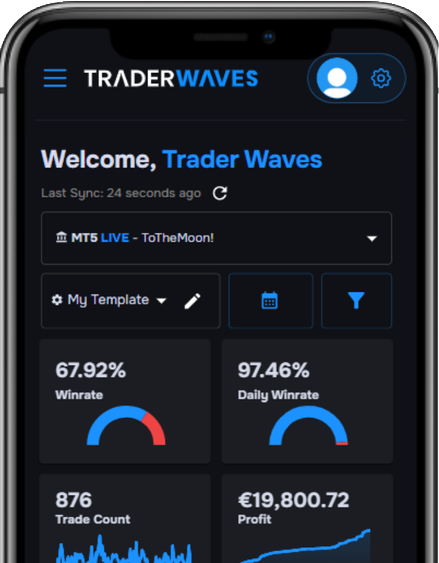

Analyze, Optimize, Profit

The Ultimate Toolkit for Traders Serious About Improving Results.

Powered by

Advanced Charting is displayed using TradingView's technology, a platform that offers tools and data for comprehensive market research: here, you can track the latest events in the Economic calendar, watch live prices, and much more.